Managing cash flow is a critical challenge for businesses and individuals. An Overdraft Loan (OD Loan) or Flexi Loan provides financial flexibility by allowing borrowers to withdraw funds as needed, within a pre-approved limit. Unlike traditional loans, interest is charged only on the amount utilized, making it an ideal solution for working capital and short-term financial needs.

In this article, we’ll explain how Overdraft Loans and Flexi Loans work, their benefits, and how Bravima Solution, in collaboration with NBFC banks, can help you access the best financing options.

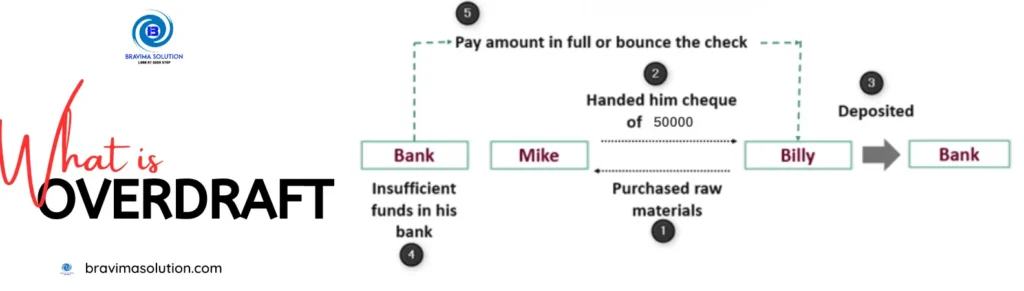

What is an Overdraft Loan (OD Loan)?

An Overdraft Loan is a type of credit facility where a bank or NBFC allows a borrower to withdraw more money than what is available in their account, up to a pre-approved limit. This facility is often provided to businesses and individuals to manage short-term liquidity gaps.

Key Features of an Overdraft Loan:

- A revolving credit facility with no fixed repayment schedule.

- Interest charged only on the utilized amount and not the entire limit.

- Flexible withdrawal and repayment options.

- Secured or unsecured options depending on the borrower’s credit profile.

What is a Flexi Loan?

A Flexi Loan is a special type of overdraft loan that offers even more flexibility. It allows borrowers to withdraw funds as needed and repay at their convenience, similar to a credit line.

Key Features of a Flexi Loan:

- No fixed EMI payments – Pay only for the amount you use.

- Unlimited withdrawals and deposits within the sanctioned limit.

- Reduced interest burden – Interest is charged only on the amount withdrawn.

- Pre-approved loan limits based on financial eligibility.

Benefits of Overdraft and Flexi Loans

1. Immediate Access to Funds

Overdraft loans provide instant liquidity to cover unexpected business expenses or personal financial emergencies.

2. Interest Savings

Unlike term loans where interest is charged on the full loan amount, OD and Flexi Loans charge interest only on the utilized portion.

3. Flexible Repayment

No strict repayment schedules; borrowers can repay the amount at their convenience, subject to minimum requirements.

4. Improved Cash Flow Management

Helps businesses maintain smooth cash flow without the burden of a fixed EMI.

5. No Collateral Required (in Some Cases)

Depending on your credit profile, some NBFCs offer unsecured OD loans without requiring collateral.

How to Apply for an Overdraft Loan with Bravima Solution

Bravima Solution partners with top NBFC banks to provide the best overdraft and flexi loan options tailored to your financial needs.

Step-by-Step Application Process:

- Check Eligibility – Evaluate your financial profile to determine eligibility.

- Choose Loan Type – Select between an overdraft loan or a flexi loan based on your needs.

- Submit Documents – Basic KYC, income proof, and business financials may be required.

- Approval & Limit Sanctioning – NBFCs assess your creditworthiness and approve a loan limit.

- Withdraw as Needed – Access funds as required, paying interest only on the utilized portion.

FAQs About Overdraft Loans & Flexi Loans

1. Who can apply for an overdraft loan?

Individuals, self-employed professionals, and businesses with a good credit profile can apply for an overdraft loan.

2. How is interest calculated on an overdraft loan?

Interest is charged only on the amount withdrawn, not on the entire sanctioned limit.

3. Is collateral required for an overdraft loan?

It depends on the NBFC’s policy. Some overdraft loans are unsecured, while others may require collateral.

4. What is the difference between a flexi loan and an overdraft loan?

A flexi loan is a type of overdraft facility with even more repayment flexibility, allowing unlimited withdrawals and repayments.

5. How can Bravima Solution help in getting an overdraft loan?

Bravima Solution connects you with top NBFC banks to find the best overdraft loan or flexi loan with competitive interest rates and flexible terms.