Kolkata, a fast-growing economic hub in Eastern India, houses thousands of salaried professionals, SMEs, and traders who often require quick access to funds. An overdraft loan can be a practical solution — especially when approved the same day. With Bravima Solution Pvt Ltd, you can get instant access to Same-Day Overdraft Loan Approval in Kolkata through trusted NBFC partners like Tata Capital and Bajaj Finserv.

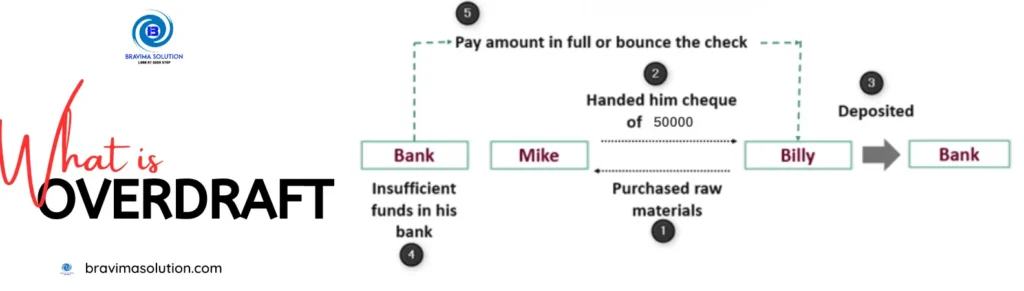

What Is an Overdraft Loan?

An overdraft (OD) loan is a credit facility that allows borrowers to withdraw more money than they have in their bank account — up to a set limit. Interest is charged only on the utilized amount and for the duration used, making it a cost-effective solution for short-term financial needs.

Why Choose Same-Day Overdraft Loan in Kolkata?

- Instant Fund Access – Approvals within 24 hours

- No Usage, No Interest – Pay interest only when you withdraw

- Flexible Repayment Options – Pay as you use

- Unsecured Facility – No collateral required (for eligible profiles)

- Ideal for Emergencies – Salaries, vendor payments, raw material purchase, etc.

Who Can Apply?

You can apply for a same-day overdraft loan in Kolkata if you are:

- A salaried employee with a fixed income

- A business owner or trader needing short-term capital

- A professional (doctor, CA, consultant) with irregular cash flows

- A self-employed individual or freelancer with a regular income stream

Short on Cash? Quick Overdraft Loans to the Rescue!

Overdraft Loan Features Offered by NBFCs

| Feature | Tata Capital | Bajaj Finserv |

| Loan Limit | ₹50,000 – ₹25 Lakhs | ₹50,000 – ₹20 Lakhs |

| Approval Time | Within 24 hours* | Same-day disbursal* |

| Collateral | Not required (for select profiles) | Not required |

| Interest Rate | Starts from 14% p.a.* | Starts from 13% p.a.* |

| Repayment Flexibility | Flexible, usage-based | Monthly interest / bullet options |

| Eligibility | Based on income, CIBIL, employer | Based on credit profile |

*Terms and limits may vary based on creditworthiness and loan policies.

Documents Required for Same-Day Overdraft Loan

Here’s what you typically need:

For Salaried Individuals:

- PAN and Aadhaar Card

- Latest 3 months’ salary slips

- Last 6 months’ bank statement

- Employer ID card (if required)

For Business Owners:

- PAN, Aadhaar, GST Certificate

- Business registration documents

- ITRs for past 2 years

- Last 6–12 months’ bank statement

Bravima Solution ensures minimal documentation and assists you throughout the process.

How to Apply for Same-Day Overdraft Loan in Kolkata via Bravima Solution

- Share Your Requirement

– Call or apply online via Bravima Solution’s contact form. - We Match You with the Right NBFC

– Based on your profile, we approach lenders like Tata Capital or Bajaj Finserv. - Quick Document Collection

– Upload or email required documents — we assist you throughout. - Approval & Disbursal Within 24 Hours

– Funds are credited directly to your bank account or overdraft facility is activated.

Emergency Funds Needed? Grab an Overdraft Loan Fast!

Where in Kolkata Do We Offer Support?

We cover all major locations in Kolkata, including:

- Salt Lake City

- Rajarhat

- Park Street

- New Town

- Behala

- Howrah

- Dum Dum

- Garia

- Ballygunge

- Esplanade

Whether you run a retail shop in Bara Bazar or are a salaried executive in Sector V, we’ve got you covered.

Why Choose Bravima Solution for Overdraft Loans?

- Quick Approvals – Same-day decisions for eligible customers

- Trusted NBFC Partners – Tata Capital, Bajaj Finserv, and more

- Transparent Process – No hidden fees or complicated paperwork

- Customized Support – We help you choose the right product for your needs

Real Use Cases from Kolkata Clients

- Mr. Sinha, a garment trader in Burrabazar, needed ₹5 lakh to buy inventory. Got an overdraft limit sanctioned in 6 hours.

- Ms. Bose, a salaried HR manager from Salt Lake, used an overdraft to handle urgent home repairs without touching savings.

- Dr. Roy, a clinic owner in New Alipore, used an overdraft facility to upgrade diagnostic equipment.

FAQs – Same-Day Overdraft Loans in Kolkata

Q1. Can I get an OD loan in 24 hours?

Yes, Bravima helps secure overdraft loans from top NBFCs in a single day.

Q2. What if I have an average CIBIL score?

Some NBFCs allow OD loans for scores starting at 685. Bravima can guide you to the right lender.

Q3. Are these loans unsecured?

Yes. Overdraft loans through Tata Capital and Bajaj Finserv are unsecured — no collateral needed.

Conclusion

If you’re in Kolkata and need urgent funds, Same-Day Overdraft Loan Approval is now a real possibility with Bravima. Partnered with Tata Capital and Bajaj Finserv, we offer flexible, fast, and transparent OD loans to help you handle any financial challenge smoothly.

Overdraft Alert? Get an Instant Overdraft Loan Today!

Similar blogs

- Which is better Term Loans vs Overdraft LoansWhen applying for a business or personal loan, borrowers often come across two options—Term Loan and Overdraft Loan (OD Loan).… Read more: Which is better Term Loans vs Overdraft Loans

- What is an Overdraft Loan (OD) || Flexi Loan?Managing cash flow is a critical challenge for businesses and individuals. An Overdraft Loan (OD Loan) or Flexi Loan provides… Read more: What is an Overdraft Loan (OD) || Flexi Loan?

- Understanding Overdraft Loans: How Do They Work?In times of financial need, borrowing options such as overdraft loans can provide quick access to funds. Unlike traditional loans,… Read more: Understanding Overdraft Loans: How Do They Work?

- Understanding Overdraft Loan Repayment Terms: A Complete GuideAn overdraft loan is a flexible credit facility that allows individuals and businesses to withdraw money beyond their account balance,… Read more: Understanding Overdraft Loan Repayment Terms: A Complete Guide

- Understanding Overdraft Loan Against PropertyIn the world of financial solutions, an overdraft loan against property (LAP) stands out as a unique offering that combines… Read more: Understanding Overdraft Loan Against Property

- Top Overdraft Loan Providers in IndiaWhen it comes to managing short-term financial needs, many people immediately think of a personal loan. But did you know… Read more: Top Overdraft Loan Providers in India